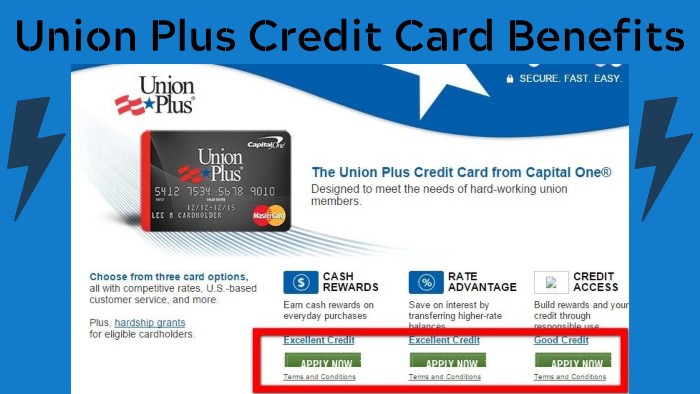

The non-profit organization Union Plus Credit Card has offered benefits to current and former union members since 1986. One such benefit is eligibility for the Union Plus credit card provided by Capital One. The União Plus program has helped many people to recover from negative financial situations, and the credit card is one of the means used by these members to do so. If you are unionized and looking for a credit card that is perfect for you, nothing else will give you the benefits offered by the Union Plus credit card. Here are 10 benefits of a Union Plus credit card.

Advantages Of A Union Plus Credit Card

- Refund

Earning cash back on purchases is always a plus, and with this credit card, you can earn 1.5% cashback on all your purchases. Additionally, there is no limit to the amount of cashback you can earn; So the more you swipe, the more money you have.

- No annual fees

This is especially helpful for union members who are trying to get back on their feet. Having fees for everything is really a hassle, and the Union Plus credit card is one less thing to worry about. The credit card has absolutely no annual fees, so you can be sure you won’t have to worry about any charges other than interest, as long as you pay your credit card on time.

- Introductory APR

Different credit cards offer different APRs, and not all offer an introductory APR. The Union Plus credit card offers all new cardholders a 0% introductory APR on purchase and transfer. For you, that means you don’t have to worry about interest for the first 12 months.

- Balance transfer

You can use this credit card to transfer funds from other credit cards. If you’re trying to consolidate some of your credit card debt, this could be a possibility. Union Plus also offers competitive transfer fees of just 3%. This is one of the lowest rates you’ve ever seen.